It is the year 2036. The 26th Investment Arbitration Day is held in Prague. Good a half of the discussions is dedicated to different issues related to mediation of the investment disputes. They are, however, not regarded as an outlandish, but rather as an up-to-date topic. Indeed, there is only a couple of BIT and trade agreements that do not contain an efficient and working system enabling mediation and other consensus based procedures prior to arbitration.

The agreed settlements concluded with the help of respected professional mediators are respected both by states and investors and in those rare cases, when the enforcement is needed, parties profit from the New York Convention II on the enforcement of mediated settlement agreements adopted back in 2020.

Furthermore, the public does not consider the investment dispute resolution system as serving to the unjustified enrichment of the multinational corporation. The arbitration, that remains the dominant tool used to the investor-state disputes’ resolution has got back its deserved respect…

It is about time to move up a gear…

Are the previous lines rather sci-fi or more or less accurate prediction? There would be different opinions held by the supporters and opponents of mediation in investor-state disputes. The both groups would, however, agree on one thing: We are still far away from this happening.

Are the previous lines rather sci-fi or more or less accurate prediction? There would be different opinions held by the supporters and opponents of mediation in investor-state disputes. The both groups would, however, agree on one thing: We are still far away from this happening.

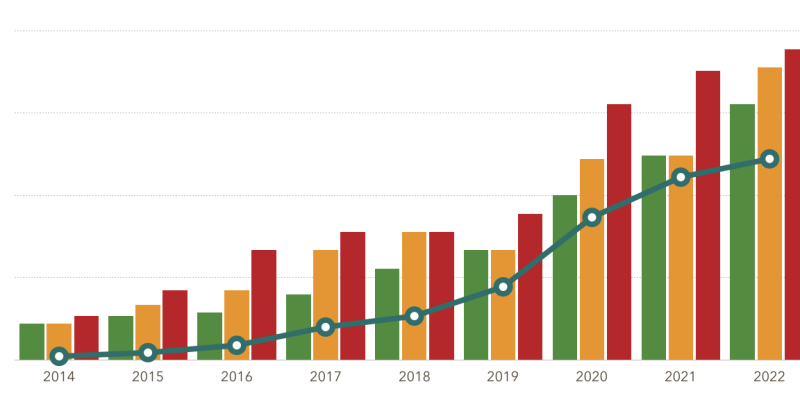

In recent days and months, one could witness a series of events being able to show that there are some glimmers of hope on the horizon. More precisely, there has been four glimmers, some of them, however, very promising.

Modern Trade Agreement = Mediation

First, the recent negotiations related to the trade agreements between the EU, the USA and Canada have shown that the relevant stakeholders are paying a lot of attention to mediation. It plays, at least nominally, a significant role in the respective investment chapters of the mentioned tools.

For instance, the TTIP draft text states that

“any dispute should, as far as possible, be settled amicably through negotiations or mediation and, where possible, before the submission of a request for consultations (…).”

The same document also foresees a creation of mediation rules and of a list mediators. The last should consist of six individuals, of high moral character and recognised competence in the fields of law, commerce, industry or finance, who may be relied upon to exercise independent judgment and who are willing and able to serve as mediators.

Of course, the question that remains to be answered is how many cases will be entrusted to mediation in reality. In other words, whether there would be a frequent use or whether it will just follow the destiny of conciliation that has never proofed to be massively used dispute resolution procedure (for instance, the ICSID has administered only ten cases).

One swallow does not make a summer, but someone has to be first

Second, there has been a some activity within the relevant institutions focussing on investment dispute resolution. As a matter of example, the Energy Charter Conference adopted the Guide on Investment Mediation in July 2016. This document is designed to explain the mediation process in general and comprehensive way and show the extent of its possible use in investment milieu. Since the Energy Charter Secretariat (ECS) belongs to the most influential institutions in the field, this initiative is especially important. According to the authors of said document, the aim was to create an explanatory document that could be voluntarily used by governments and companies to take the decision on whether to go for mediation and how to prepare for it. Such paper alone will not change the layout, however, it might be considered as a great example of future activities. For only by addressing the relevant stakeholders, mediation might become part of regularly considered choices in pre-arbitration stage.

Second, there has been a some activity within the relevant institutions focussing on investment dispute resolution. As a matter of example, the Energy Charter Conference adopted the Guide on Investment Mediation in July 2016. This document is designed to explain the mediation process in general and comprehensive way and show the extent of its possible use in investment milieu. Since the Energy Charter Secretariat (ECS) belongs to the most influential institutions in the field, this initiative is especially important. According to the authors of said document, the aim was to create an explanatory document that could be voluntarily used by governments and companies to take the decision on whether to go for mediation and how to prepare for it. Such paper alone will not change the layout, however, it might be considered as a great example of future activities. For only by addressing the relevant stakeholders, mediation might become part of regularly considered choices in pre-arbitration stage.

Third, there has been initiative by the IMI to introduce the IMI Competency Criteria for Investor-State Mediators as by September 19, 2016. The aim of this instrument is to provide parties, institutions, designating authorities and other appointing bodies with a guidelines that would help them with the selection of a competent and suitable mediator.

Obstacles to be tackled

Last but not least, there has been an increasing tendency to address the issue of mediation at the different venues dedicated to the investment dispute resolution. One especially interesting opportunity to discuss this topic appeared last week at the 6th Investment Treaty Arbitration Conference hold in Prague. This event hosted at the wonderful premises of the Czernin Palace was attended by the leading professionals in the field such as prof. Emmanuel Gaillard (Shearman & Sterling), Martina Polasek (ICSID), Bart Legum (Dentons) and many others. One of the conference’s section was dedicated to use of mediation of investment disputes. Wolf von Kumberg a member of ArbDB Chambers London, made a presentation about the main obstacles preventing the use of consensual dispute resolution in the field.

Last but not least, there has been an increasing tendency to address the issue of mediation at the different venues dedicated to the investment dispute resolution. One especially interesting opportunity to discuss this topic appeared last week at the 6th Investment Treaty Arbitration Conference hold in Prague. This event hosted at the wonderful premises of the Czernin Palace was attended by the leading professionals in the field such as prof. Emmanuel Gaillard (Shearman & Sterling), Martina Polasek (ICSID), Bart Legum (Dentons) and many others. One of the conference’s section was dedicated to use of mediation of investment disputes. Wolf von Kumberg a member of ArbDB Chambers London, made a presentation about the main obstacles preventing the use of consensual dispute resolution in the field.

The idea attracted the attention of the audience constituted by governments’ representatives, lawyers and arbitrators. In the following discussion, the will of the state representatives to agree on any kind of settlement was discussed. According to some in the audience, it was questionable whether the relevant State representative would be keen to add their signature to the settlement agreement with the prospect of later being prosecuted for alleged corruption or other crimes for political reasons. In this respect, there was a voice stating the concern that mediation would be conducted only in the developing states where the rule-of-law does not apply. However serious these concerns, the corruption paranoia cannot be regarded as a reason for abandoning the settlement when such is possible (and legal). Failing to settle under reasonable terms may simply cost a State much more in an award later on. Looking at it from the cost benefit perspective of the tax payer, a mediated settlement makes much more sense.

And Finally the Enforcement

Another point was risen in relation to the absence of the cross border enforcement of mediated settlement agreements. In this regard, the brighter day might come as the UNCITRAL Working Group II held its 65th session in Vienna. During the deliberations, the draft convention on the enforcement of mediated settlement agreements was discussed with various success. Despite the fact that it remains to be answered what form the final instrument will take, it is almost clear that the limitation to commercial disputes will prevent its use in investment cases. This has to be considered as a real drawback of the proposed convention that might deserve some further reconsiderations.

Another point was risen in relation to the absence of the cross border enforcement of mediated settlement agreements. In this regard, the brighter day might come as the UNCITRAL Working Group II held its 65th session in Vienna. During the deliberations, the draft convention on the enforcement of mediated settlement agreements was discussed with various success. Despite the fact that it remains to be answered what form the final instrument will take, it is almost clear that the limitation to commercial disputes will prevent its use in investment cases. This has to be considered as a real drawback of the proposed convention that might deserve some further reconsiderations.

To conclude, once used in investor-state disputes, mediation might bring two substantive advantages for both investors and States. First, instead of decision, it brings solutions. Thus, unless the investors are only seeking for satisfaction in punishment, they should appreciate having the compensation in as early stage as possible. Furthermore, settlement usually prevents the complications that are common in relation to the enforcement of an award.

Second, the States declaring their will to find an amicable consensual solution are advertising a friendly atmosphere and approach that is alway appreciated by the investors.

And is not the support of the investments one of the main goals why the whole system was created?

________________________

To make sure you do not miss out on regular updates from the Kluwer Mediation Blog, please subscribe here.