In the first of a two-part article, NZ/UK mediator Geoff Sharp looks at the development of third-party funding of litigation, arbitration and mediation in part 1 and later in part 2 Geoff and Bill Marsh will compare notes on how TPF impacts the mediation process

Third party funding (TPF) of claims has been around for quite some time. Historically however, some jurisdictions have prohibited a stranger to a lawsuit financing the claim of another in return for a share of the spoils.

Over time that has changed as many jurisdictions overcome fears that litigation financing somehow perverts the course of justice – that a third-party funder “might be tempted, for his own personal gain, to inflame the damages, to suppress evidence or even suborn witnesses” (Lord Denning in the Trepca Mines Case 1963).

Over the intervening years, concerns over access to justice have come to trump the very real risks of third-party funding and as a result many jurisdictions have relaxed notions of champerty and maintenance.

Just in the last fortnight the Court of Appeal (UK) confirmed that position in the long running Excalibur Ventures v Texas Keystone case saying “Third party funding is a feature of modern litigation” and that it is “an accepted and judicially sanctioned activity perceived to be in the public interest.”

So the tide has definitely turned and the last couple of years have seen a dramatic increase in the level of TPF generally, with most funding confined to lawsuits (i.e. those claims bought in the courts). However, we are now seeing a similar rise in levels of arbitration funding and in particular, the international commercial arbitration community appear to be embracing TPF with many jurisdictions like Singapore and Hong Kong responding with enabling legislation.

These South East Asian jurisdictions are reforming to allow funded arbitration to ensure their continuing status as favoured dispute resolution hubs. On 7 November 2016 the Civil Law (Amendment) Bill was introduced in the Singaporean Parliament allowing for third-party funding of arbitration by early 2017 and Hong Kong is currently in a consultation process that will see a similar result.

With the rise of TPF in litigation and arbitration, it follows that funding of mediation is also on the increase, given that much mediation happens along side these two dispute processes and in the 2nd part of this article we will look at the consequences of TPF for the mediation process itself, in particular the dynamics of the mediation table itself, but first…

What is TPF and how does it work?

Well, at its most simple, it’s not complicated.

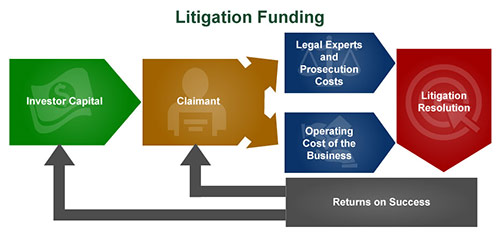

Although TPF products offered by third-party funders are now quite sophisticated, basically TPF is the funding of litigation or arbitration parties (usually claimants and increasingly class claimants) in return for a share of the proceeds.

“Litigation funding is where a third party provides the financial resources to enable costly litigation or arbitration cases to proceed. The litigant obtains all or part of the financing to cover its legal costs from a private commercial litigation funder, who has no direct interest in the proceedings. In return, if the case is won, the funder receives an agreed share of the proceeds of the claim. If the case is unsuccessful, the funder loses its money and nothing is owed by the litigant” (Association of Third Party Funders – England and Wales)

On one view, TPF is simply another way to fund claims there having always been a number of ways to pay the costs of pursuing a claim in the courts or in arbitration – obviously, parties can simply fund their own costs, or equally, they may finance them by a loan from their bank or they may negotiate a fee structure with their lawyer (e.g. a no win, no fee contingency arrangement or a success fee conditional upon the result of the litigation).

Third-party funding however is different – a funded party will not normally have to pay any amount back to the third-party funder if the proceedings are unsuccessful. And these days it’s not only for financially distressed claimants who lack the ability to bring a claim.

As Ruth Stackpool-Moore, Director of Litigation Funding at Harbour Litigation Funding says, claimants approach her organisation with a request to fund for a variety of reasons ranging from hedging risk to not having a legal budget to fight the case.

To record the funding arrangement, the third-party funder and the funded party sign a Third-Party Funding Agreement covering the matters you would expect, including what and how the funder gets paid out of a money judgement or award, the degree of the funder’s control over the conduct of the proceedings, what happens if there is a disagreement (for instance, around settlement), the funders liability for things like adverse costs orders or security for costs etc. Such agreements are usually bespoke and very much depend on the individual circumstances.

TPF Issues

One of the issues currently exercising a number of jurisdictions is whether there should be greater regulation of the TPF industry to mitigate risk of abuse.

Some, like in England, favour self-regulation where funders subscribe to a voluntary code of conduct setting out capital adequacy requirements, ethical matters, limitation on the withdrawal of funding and what happens in the event of disagreement etc. A particularly important question is the funder’s level of control and ability to influence the conduct of a claim. There are competing views depending upon the jurisdiction – for instance ALF’s voluntary code takes a relatively conservative position requiring a funder “not seek to influence the Funded Party’s solicitor or barrister to cede control or conduct of the dispute to the Funder”.

The alternative view is that since a funder is putting up the money and has a stake in the outcome, important decisions like who to appoint as arbitrator or whether to settle at a particular level are quite properly a matter for funder input.

Jane Player of King & Spalding says “As an adviser I think funders are here to stay and the good ones leave you alone to run the case and report back at regular intervals on a risk assessment basis… I see [funders] as a positive influence as they often lend objective thinking to ultimate settlement offer discussions”

The reality is that there is usually little disagreement between the parties to a Third-Party Funding Agreement where it has been well drafted following a solid due diligence process and more importantly where there is effective communication between the parties who understand what is expected of each other.

Ruth Stackpool-Moore again; “When we do our due diligence we try to establish not only the legal merits of the claim, but also the realistic value and the realistic budget. We then agree the cost of funding based on the risks, the size and length of the case. Our pricing process – agreed upfront with the claimant – includes discussions regarding their settlement expectations. Our terms are clearly expressed in our funding agreement, so the claimant can calculate with ease how much they will owe us at all times“.

Steven Friel, Chief Investment Officer at Woodsford Litigation Funding says;

“Ultimate control rests with the claimant and the claimant’s lawyers. We have the right to provide input, but we don’t necessarily have veto rights. Ultimately, however, my objective as a commercial funder is to ensure that I choose and cultivate the relationships with my claimants in such a way that I rely on cooperation, rather than strict contractual rights, when advancing my position in relation to settlement.

I am delighted to say that I have never found myself in dispute with one of my claimants in relation to settlement (or anything else, for that matter). If there is a dispute however, it is open to either party to refer it for expert determination”.

So, what kind of claims attract third-party funding?

Well, they are usually high value and often international.

There are varying reports of how strong a case must be before it will interest a third-party funder – some reports have that as low as 60% chance of success or as high as 85% – the Jackson Preliminary Report (2009) put it at around 70% for UK funders. Harbour Litigation Funding will fund a claim value greater than £10 million and the only cases unsuitable for funding are divorce and personal injury cases.

One thing is for sure, funders will normally undertake their own case assessment and only fund a very small proportion of the those offered to them.

Steven Friel again;

“We will only fund meritorious claims, pursued by motivated claimants against solvent defendants, where costs are proportionate to the likely recovery, and where the governing law and jurisdiction afford relative certainty”.

In part two of this article Geoff Sharp and Bill Marsh look at what factors are taken into account in deciding whether or not to take a funded case to mediation, how funders decide whether to attend on mediation day and what impact that has on the mediation dynamic, what role they do play if they do attend and the volume of funded cases actually going to mediation… and more

In the meantime, an excellent publication with a focus on contemporary issues in third-party funding of arbitration is Norton Rose Fulbright’s International Arbitration Report, issue 7, September 2016

________________________

To make sure you do not miss out on regular updates from the Kluwer Mediation Blog, please subscribe here.

Geoff – this is a fascinating and, for me, troubling topic. It’s intriguing also to read of the moves to legitimate TPF in Singapore, especially in light of the prevailing uncertainty about the acceptability of third party “stakeholders” in litigation. Maybe, as you suggest, the desire to retain a position as preferred DR locations prevails; or as Tommy Koh has commented: “Singapore has raised pragmatism to the level of a philosophy. Singapore stands against the beauty of ideas in favour of what works” (Tommy Koh, quoted in Robert D Kaplan, Asia’s Cauldron: The South China Sea and the End of a Stable Pacific, Random House, 2014, p. 93).

What do you anticipate TPF might do to the kinds of outcomes parties might seek in mediation, if there are fiscal interests in the result? Will this potentially limit the more flexible and creative options that mediation can often allow?